USDA loan refinance: Adjust Your Mortgage to Fit Your Current Budget.

USDA loan refinance: Adjust Your Mortgage to Fit Your Current Budget.

Blog Article

Optimize Your Financial Freedom: Advantages of Loan Refinance Explained

Loan refinancing provides a strategic opportunity for individuals seeking to boost their financial liberty. By safeguarding a reduced interest rate or adjusting lending terms, consumers can effectively minimize month-to-month payments and boost cash money flow.

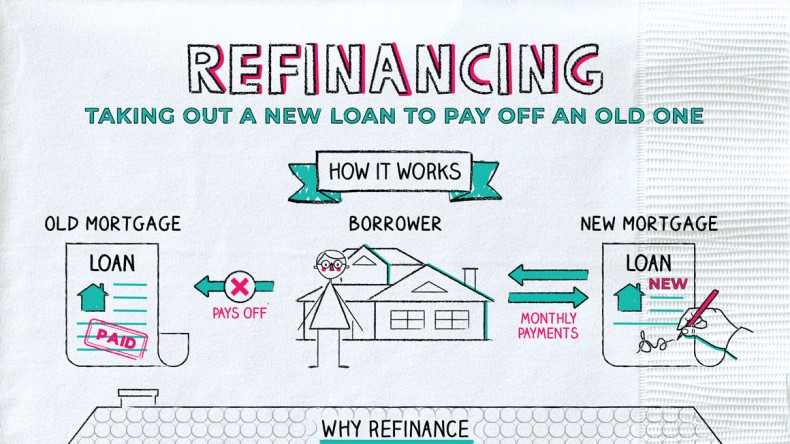

Recognizing Funding Refinancing

Understanding financing refinancing is vital for property owners seeking to optimize their financial situation. Finance refinancing entails changing a present home loan with a new one, commonly to achieve much better funding terms or conditions. This monetary strategy can be used for various reasons, consisting of readjusting the loan's period, altering the sort of rates of interest, or combining financial debt.

The key goal of refinancing is often to lower regular monthly settlements, thus boosting capital. Property owners might additionally refinance to accessibility home equity, which can be made use of for considerable costs such as home improvements or education. Additionally, refinancing can provide the opportunity to switch from a variable-rate mortgage (ARM) to a fixed-rate home mortgage, supplying even more stability in monthly settlements.

However, it is crucial for property owners to evaluate their financial situations and the connected costs of refinancing, such as closing prices and fees. A comprehensive analysis can aid establish whether refinancing is a sensible choice, balancing prospective financial savings against the initial expenditures entailed. Eventually, recognizing finance refinancing encourages house owners to make educated choices, boosting their monetary health and leading the means for lasting stability.

Reducing Your Passion Rates

Numerous property owners seek to decrease their rate of interest as a main inspiration for re-financing their mortgages. Decreasing the passion price can dramatically reduce month-to-month payments and overall borrowing expenses, permitting individuals to designate funds in the direction of various other financial objectives. When passion prices decline, re-financing provides a possibility to protect an extra favorable lending term, ultimately enhancing economic security.

Refinancing can cause substantial cost savings over the life of the finance (USDA loan refinance). Lowering an interest price from 4% to 3% on a $300,000 mortgage can result in thousands of bucks conserved in passion payments over 30 years. Additionally, lower rates may make it possible for homeowners to repay their finances quicker, hence raising equity and reducing debt faster

It is vital for homeowners to assess their current home mortgage terms and market conditions before determining to re-finance. Reviewing possible cost savings against re-financing prices, such as shutting charges, is critical for making an educated decision. By taking benefit of reduced rates of interest, homeowners can not just boost their financial flexibility but also create an extra protected economic future for themselves and their families.

Settling Debt Successfully

Home owners usually discover themselves managing numerous debts, such as credit history cards, individual car loans, and various other economic obligations, which can bring about raised tension and complicated monthly payments (USDA loan refinance). Settling debt properly through lending refinancing uses a structured remedy to handle these economic concerns

By re-financing existing car loans into a solitary, a lot more manageable funding, home owners can streamline their repayment procedure. This technique not look at here only decreases the number of month-to-month payments yet can likewise reduce the general rates of interest, depending on market conditions and private credit rating profiles. By consolidating financial debt, property owners can allocate their resources more successfully, maximizing cash circulation for essential costs or cost savings.

Adjusting Car Loan Terms

Changing lending terms can significantly impact a homeowner's monetary landscape, especially after settling current financial obligations. When re-financing a home loan, customers can modify the length of the lending, rate of interest, and repayment routines, straightening them a lot more very closely with their current monetary scenario and objectives.

As an example, expanding the finance term can reduce monthly settlements, making it easier to take care of cash circulation. This may result in paying even more rate of interest over the life of the lending. On the other hand, deciding for a much shorter loan term can bring about higher monthly payments but substantially minimize the total rate of interest paid, permitting customers to build equity much more rapidly.

Additionally, adjusting the rate of interest price can influence overall cost. Property owners may change from an adjustable-rate home loan (ARM) to a fixed-rate home loan for security, securing reduced prices, especially in a positive market. Refinancing to an ARM can provide lower first settlements, which can be helpful for those anticipating an increase in earnings or economic circumstances.

Improving Capital

Refinancing a home mortgage can be a tactical approach to enhancing check these guys out capital, permitting borrowers to designate their financial sources better. By protecting a reduced rate of interest or prolonging the funding term, homeowners can dramatically reduce their regular monthly mortgage repayments. This prompt reduction in expenses can liberate funds for other crucial demands, such as repaying high-interest financial obligation, saving for emergencies, or spending in possibilities that can generate higher returns.

Moreover, refinancing can supply debtors with the choice to convert from an adjustable-rate home loan (ARM) to a fixed-rate home mortgage. This transition can maintain monthly repayments, making budgeting simpler and boosting monetary predictability.

Another avenue for improving capital is through cash-out refinancing, where homeowners can obtain against their equity to accessibility liquid funds. These funds can be utilized for home renovations, which may raise residential property value and, subsequently, capital when the home is marketed.

Final Thought

In verdict, finance refinancing offers a critical opportunity to boost monetary flexibility. By reducing interest rates, settling financial obligation, readjusting lending terms, and boosting cash money circulation, people can attain a much more desirable monetary position.

Report this page